Zirtue

Peer-to-peer lending app

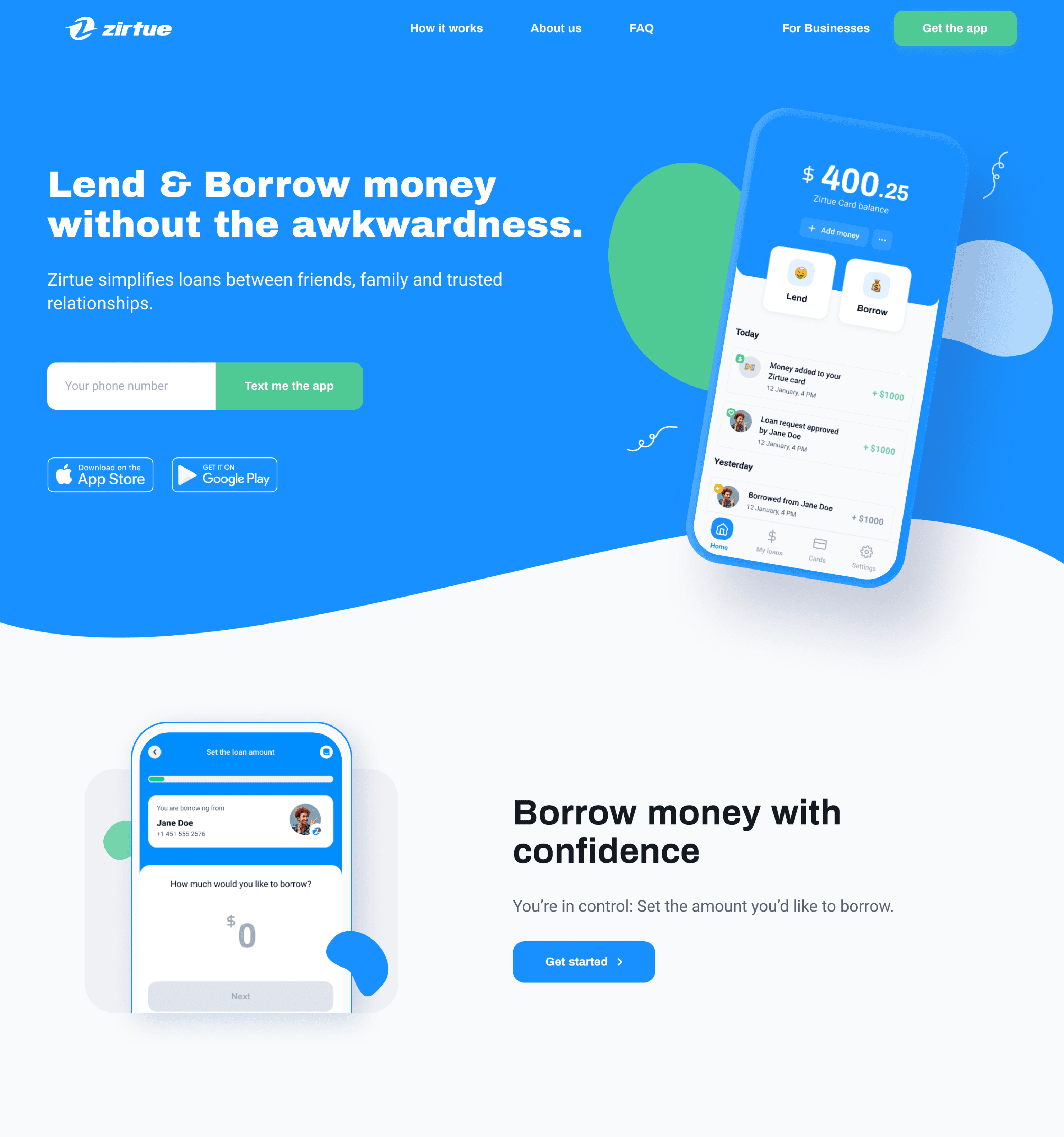

Removing the awkwardness of lending

to friends

After discovering that a UI reskin wouldn’t fix the underlying problems, I advocated for and redesigned the entire experience from restructuring the core loan flows to improving repayment clarity and edge-case handling. This approach strengthened user trust and set the foundation for a more consistent, dependable product that better supports real relationships.

Fintech

P2P

UX/UI

Cross-platform

Prototyping

⟡ Loading ⟡

Role / Scope:

Lead Product Designer. Owned app and website redesign, aligning design strategy with user research insights. Partnered closely with the UX researcher, PM, and cross-functional stakeholders (CEO, PO, engineering team) to transform Zirtue’s complex, compliance-heavy lending flows into a trustworthy, relatable experience.

Timeframe

2020–2021 (7 months)

MVP

Continuous iteration across app and web.

Constraints

High sensitivity: Money between friends/family demanded UX that balanced empathy, trust, and accountability

Business pivot: Initially scoped as a “UI reskin,” expanded to a full UX overhaul under tight deadlines.

Compliance & partnerships: Integration with Synapse banking, Plaid verification, Mastercard, and direct-bill partners (AT&T, Toyota, UT Southwestern)

Low financial literacy & tech anxiety: Users struggled with jargon and unclear repayment terms, requiring simplified language and transparent microcopy.

Key decisions

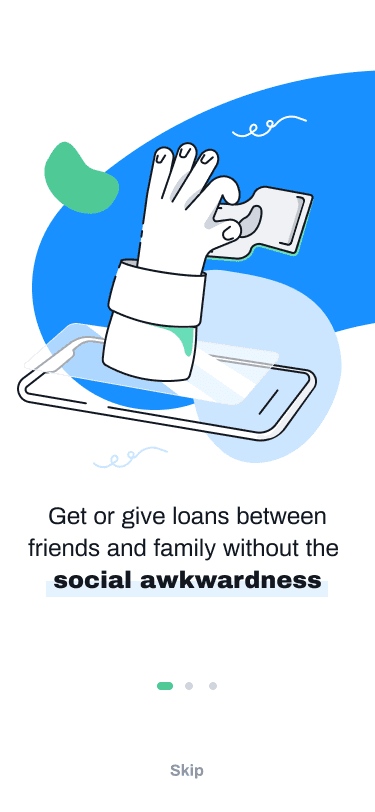

1.

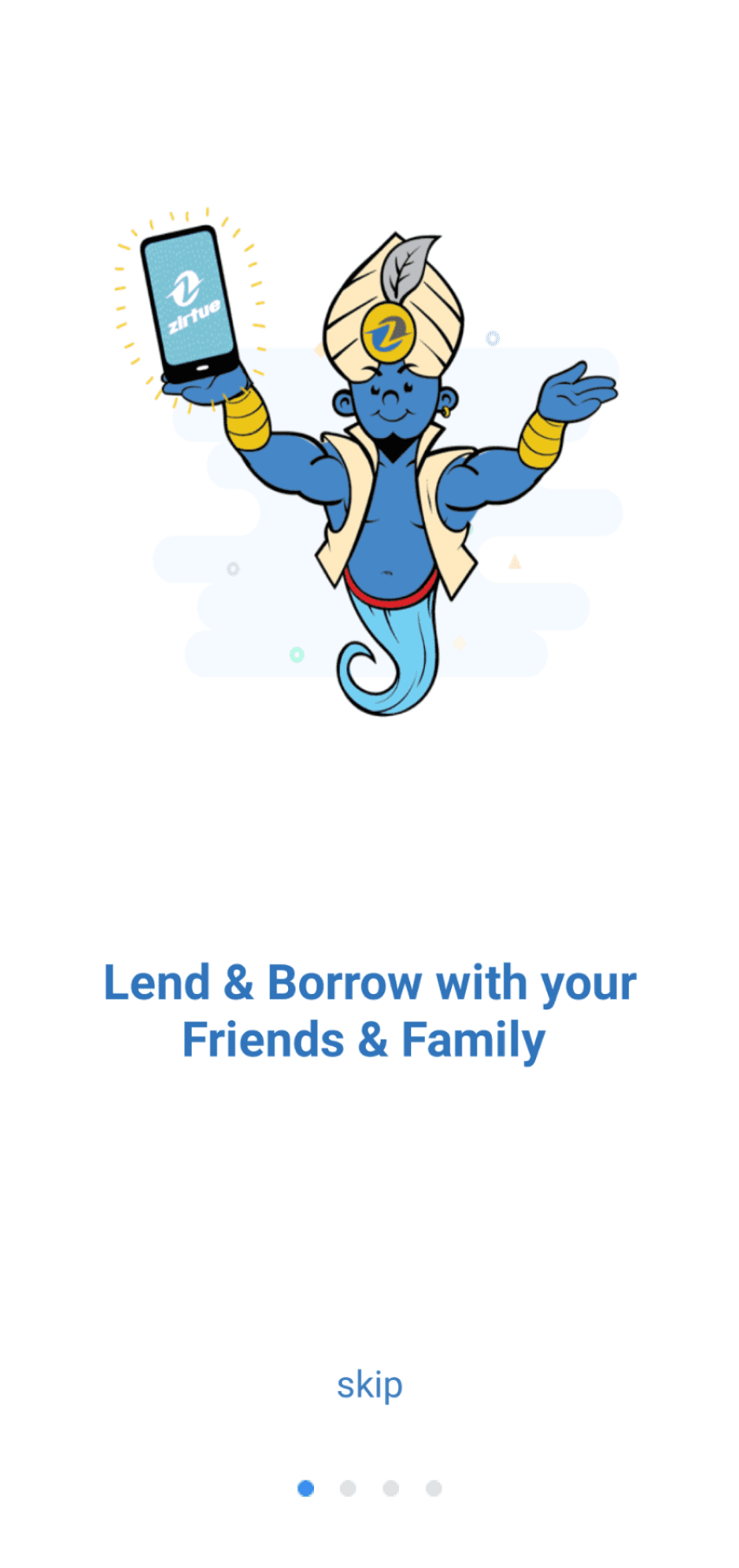

I designed a guided, plain-language flow clarifying verification (KYC/AML) steps and security rationale. Replaced confusing mascots with meaningful metaphors of “helping hand” to establish trust .

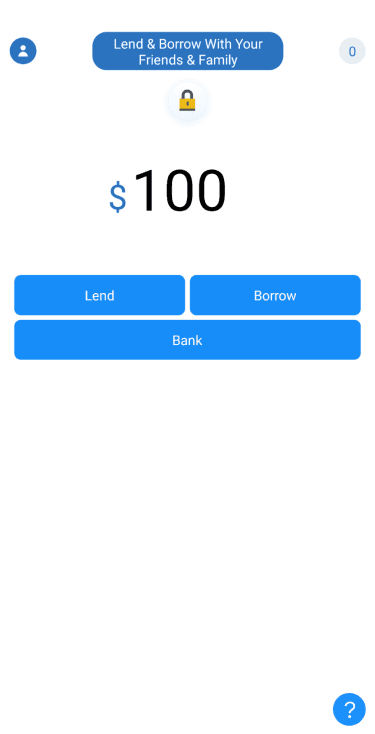

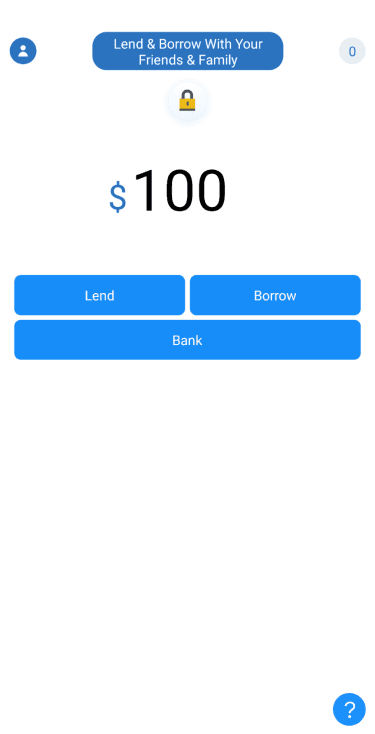

Before

First redesign

The iterated screen

2.

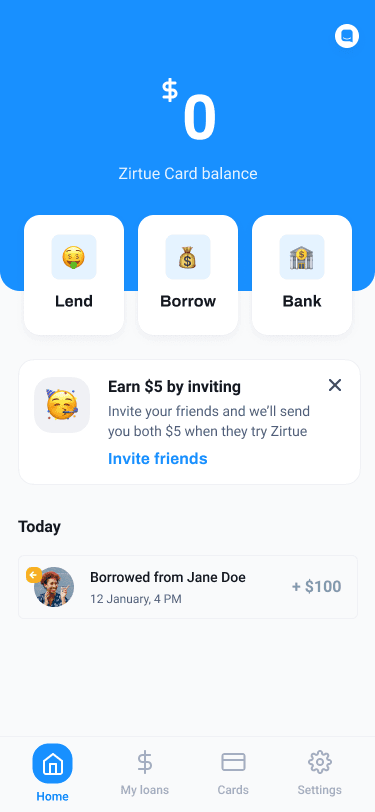

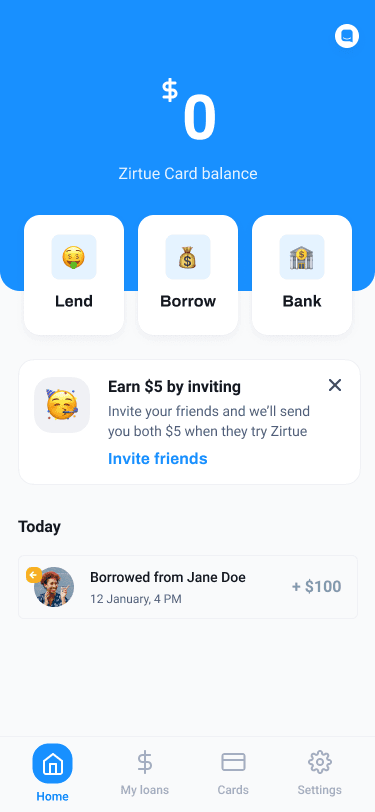

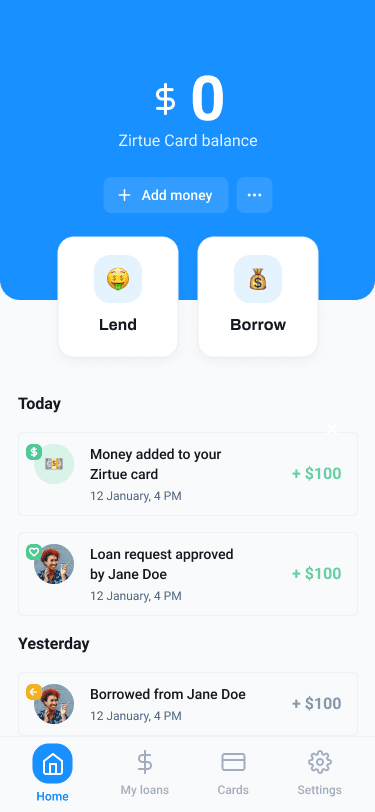

Introduced a clear home dashboard that replaced the confusing opening screen with organized loan activity and intuitive navigation.

Before

First redesign

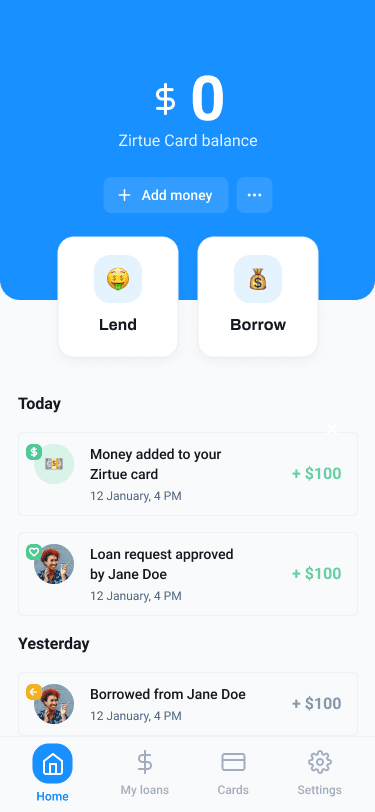

The iterated screen

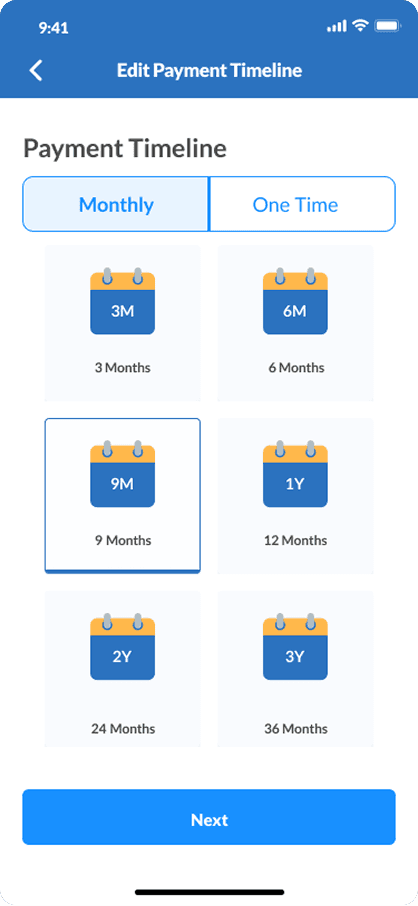

3.

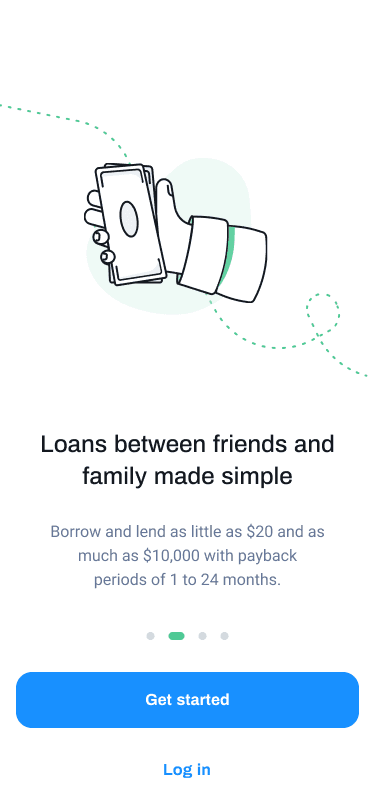

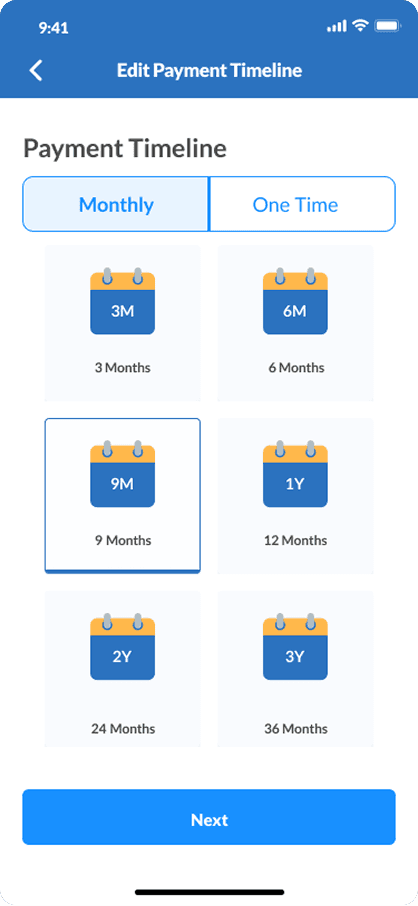

Introduced fee visibility, step indicators, and repayment previews, ensuring borrowers always knew where they stood.

Before

First redesign

Total interest

paid to lender for 3 months

$20

Total loan cost

for 3 months

$120

Borrowing from

@Jane Doe

$

100

3 months

Set your payback period

Monthly

One-time

Set your payback period

Next

The iterated screen

Borrowing $1,000 from Jane

When can you pay Jane back?

Choose a payback period between 3 to 36 months.

Monthly

One-time

3 months

Total loan cost

For 3 months

$1,008.34

Total interest

Paid to Jane

$8.34

Payback period

Apr 23

1st monthly payment

You pay $336.11 in total

with $4.17 interest

may 23

2nd monthly payment

You pay $336.11 in total

with $2.78 interest

June 23

3rd monthly payment

You pay $336.11 in total

with $4.18 interest

Next

4.

Forgive-loan and counteroffer features Collaborated with developers to map edge cases (failed payments, forgiveness, partial repayments) for real-world scenarios, maintaining usability across technical limitations.

Loan to Tom

Total loan amount

$96.80

Paid off

0%

Repayment date is June 16

June 16

Repayment plan

Loan summary

Your repayment plan

Sit back and relax while we take care of business! Your repayments from Tom will be automatically paid to your linked account during each cycle.

receveing money to

Dbs Ltd

••• 3243

Change

✌️ No fee applies

upcoming repayments

1st month

April 23

They owe $331.93

Including $4.18 interest

They pay back $336.11 in total

Report issue

View all

more actions

Forgive entire loan

You can forgive all or a portion of this loan.

The borrower will be notified about this.

They owe $1,008.34

Including $8.38 interest

You forgive $1,008.34 in total

Forgive $1,008.34

Results

Increased engagement through intuitive, trust building design.

Enhanced user confidence, visible in increased app conversions.

Direct impact on business strategy by implementing design solutions informed by user research.

Impact

Redefined how Zirtue communicates trust in peer-to-peer lending. The redesign turned a confusing, transactional experience into one that feels secure, human, and transparent, increasing user confidence while supporting business goals like repeat lending and bill-pay expansion.

Zirtue

Peer-to-peer lending app

Removing the awkwardness of lending to friends

After discovering that a UI reskin wouldn’t fix the underlying problems, I advocated for and redesigned the entire experience from restructuring the core loan flows to improving repayment clarity and edge-case handling. This approach strengthened user trust and set the foundation for a more consistent, dependable product that better supports real relationships.

Fintech

P2P

UX/UI

Cross-platform

Prototyping

Role / Scope:

Lead Product Designer. Owned app and website redesign, aligning design strategy with user research insights. Partnered closely with the UX researcher, PM, and cross-functional stakeholders (CEO, PO, engineering team) to transform Zirtue’s complex, compliance-heavy lending flows into a trustworthy, relatable experience.

Timeframe

2020–2021 (7 months)

MVP

Continuous iteration across app and web.

Constraints

Low financial literacy & tech anxiety: Users struggled with jargon and unclear repayment terms, requiring simplified language and transparent microcopy.

High sensitivity: Money between friends/family demanded UX that balanced empathy, trust, and accountability

Business pivot: Initially scoped as a “UI reskin,” expanded to a full UX overhaul under tight deadlines.

Compliance & partnerships: Integration with Synapse banking, Plaid verification, Mastercard, and direct-bill partners (AT&T, Toyota, UT Southwestern)

1.

I designed a guided, plain-language flow clarifying verification (KYC/AML) steps and security rationale. Replaced confusing mascots with meaningful metaphors of “helping hand” to establish trust .

Before

First redesign

The iterated screen

Key decisions

2.

Introduced a clear home dashboard that replaced the confusing opening screen with organized loan activity and intuitive navigation.

Before

First redesign

The iterated screen

3.

Introduced fee visibility, step indicators, and repayment previews, ensuring borrowers always knew where they stood.

Before

First redesign

Total interest

paid to lender for 3 months

$20

Total loan cost

for 3 months

$120

Borrowing from

@Jane Doe

$

100

3 months

Set your payback period

Monthly

One-time

Set your payback period

Next

The iterated screen

Borrowing $1,000 from Jane

When can you pay Jane back?

Choose a payback period between 3 to 36 months.

Monthly

One-time

3 months

Total loan cost

For 3 months

$1,008.34

Total interest

Paid to Jane

$8.34

Payback period

Apr 23

1st monthly payment

You pay $336.11 in total

with $4.17 interest

may 23

2nd monthly payment

You pay $336.11 in total

with $2.78 interest

June 23

3rd monthly payment

You pay $336.11 in total

with $4.18 interest

Next

4.

Forgive-loan and counteroffer features Collaborated with developers to map edge cases (failed payments, forgiveness, partial repayments) for real-world scenarios, maintaining usability across technical limitations.

Loan to Tom

Total loan amount

$96.80

Paid off

0%

Repayment date is June 16

June 16

Repayment plan

Loan summary

Your repayment plan

Sit back and relax while we take care of business! Your repayments from Tom will be automatically paid to your linked account during each cycle.

receveing money to

Dbs Ltd

••• 3243

Change

✌️ No fee applies

upcoming repayments

1st month

April 23

They owe $331.93

Including $4.18 interest

They pay back $336.11 in total

Report issue

View all

more actions

Forgive entire loan

You can forgive all or a portion of this loan.

The borrower will be notified about this.

They owe $1,008.34

Including $8.38 interest

You forgive $1,008.34 in total

Forgive $1,008.34

Results

Increased engagement through intuitive, trust building design.

Enhanced user confidence, visible in increased app conversions.

Direct impact on business strategy by implementing design solutions informed by user research.

Impact

Redefined how Zirtue communicates trust in peer-to-peer lending. The redesign turned a confusing, transactional experience into one that feels secure, human, and transparent, increasing user confidence while supporting business goals like repeat lending and bill-pay expansion.

⟡ Loading ⟡